Notions of value of #currencies such as Bitcoin and the US Dollar presuppose that the exact value of each coin equals its exchange rate or price at each point in time, ie, the price of one coin is only ever defined in terms of another. Alternative notions of value are also defined in relative terms (e.g., the price of gold, or ‘purchasing value’). Consequently, financial analyses focus on questions about the future: will price go up or down? We rarely agree on the answer to, What is the actual value of Bitcoin? Or ask, inter alia, What is the actual value of the US Dollar?

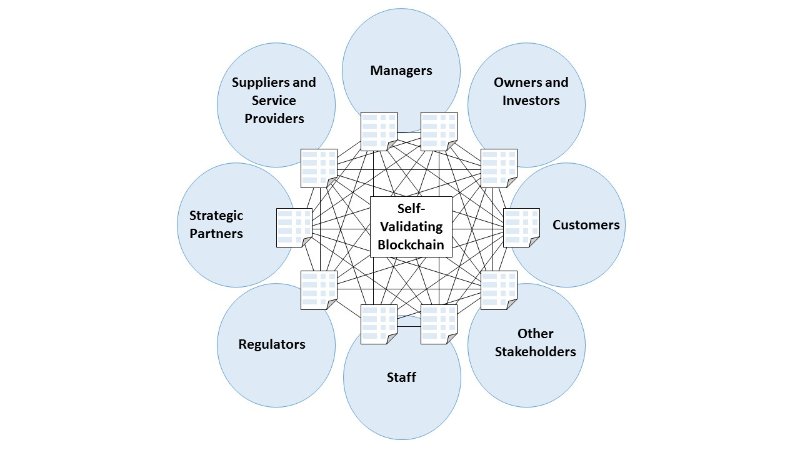

This paper examines an alternative understanding based on the assumption that currencies have utility values: at each point in time, the utility value of a currency is a physical, absolute, independent property, which can be measured just like the temperature and entropy of a gas. We define an abstract machine which models the currency’s wallets and the movement of coins between them, and postulate that utility values can be computed from the currency’s abstract machine, using data about the currency itself and nothing else. Figuratively speaking, utility values define ‘price’ without prices.

In support of this theory we use #entropy and entropy-like functions to estimate the utility values of three currencies: #Bitcoin, #Ethereum, and #Cardano. We also show that, not only do our price estimates correlate closely with market caps (94% correlation), but the utility values obtained also closely approximate (Δ=0.23) the spot exchange rates between these currencies as recorded by trading platforms for each day in between mid-2018 and mid-2022. Figuratively speaking, we calculate the prices of these coins without prices.

Full Report